TRADITIONAL INVESTMENT DISCIPLINE FOR DIGITAL ASSETS

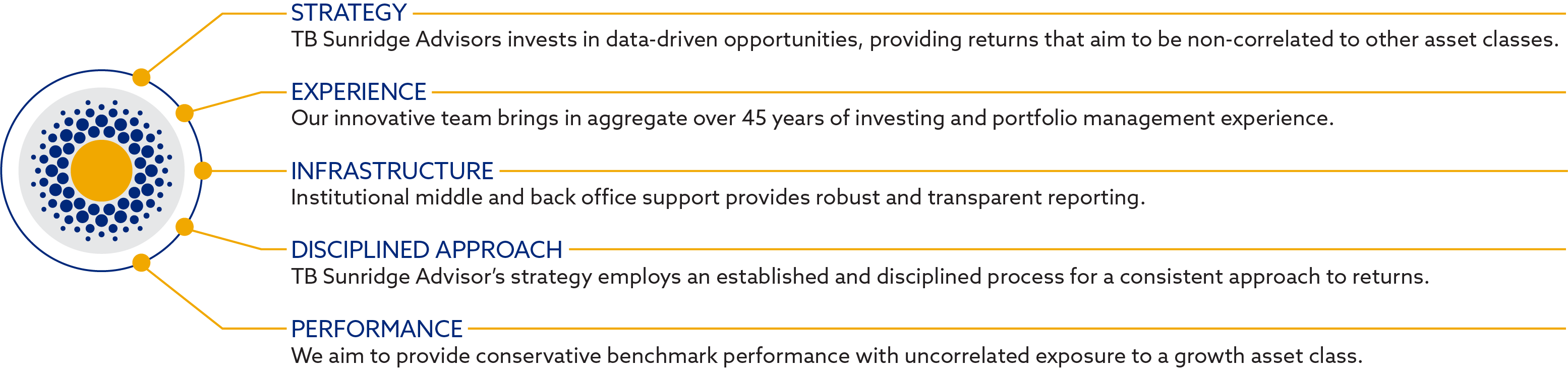

TB Sunridge Advisors manages a suite of private placement funds that provide turn-key, US-compliant investment into digital assets for institutions and accredited & qualified investors. The funds are designed to provide diversification and increase uncorrelated returns in the alternative investment space.

TB Sunridge Bitcoin Fund LP is managed by TB Sunridge Advisors. For more information and offering documents for funds that TB Sunridge Advisors provides investment advice to, please click here.

Compliance and fiduciary duty to our clients are fundamental core values and have been since the company’s inception. TB Sunridge Advisors developed proprietary policies to become one of the first investment advisors with registration approval that specifically includes Digital Assets.

“Traditional Investment Discipline” refers to portfolios built on the strategic allocation of assets such as stocks and bonds as a way of balancing risk. The framework uses a regulated methodology of holding and managing customer assets that are commonly employed for stocks, bonds, and alternative investments.

While Digital Asset Management is a relatively new investment class, the team at TB Sunridge Advisors has a long history of institutional investing and client relationship management. TB Sunridge Advisors’ expertise developed from its principals’ extensive history of portfolio management.

Our internal team of researchers works closely with leading financial economists and practitioners to identify opportunities. Our portfolio managers seek to balance costs against expected returns and diversification.

CEO

Matt serves as CEO of TB Sunridge Advisors and integrates Digital Assets into the traditional regulatory landscape to capture potential long term growth for clients. Matt brings 18 years of experience, including managing financial portfolios at JPMorgan and Credit Suisse, as well as at commodities companies where he traded and managed successful teams optimizing physical assets and financial energy products. Matt helped found and currently sits on a non-profit board for digital assets as well as several local charity organizations. Dr Tunney holds a PhD in Theoretical Physics from Cambridge University, UK.

PARK CITY OFFICE

1389 Center Dr, Ste 200

Park City, UT 84098